Option Greeks Calculator 32.0.0

Free Version

Publisher Description

Option Greeks Calculator - A simple app to calculate option greeks & get instantaneous projection on price.

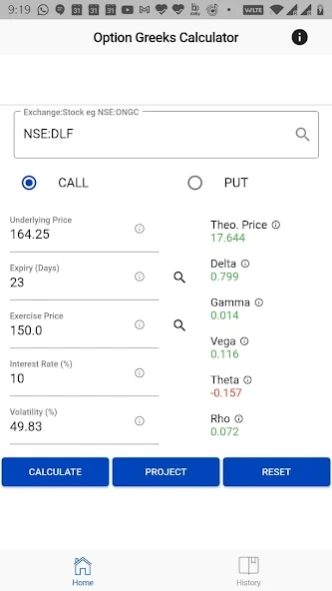

Option Greeks Calculator uses the latest modifications and improvements of Black-Scholes model to calculate most accurate theoretical call and put prices along with option greeks for European options (Not American) & make projections. You can enter underlying price or fetch the same using fetch button for exchanges across the globe. In certain cases the fetched price may be delayed by up to 15 minutes. Next, simply enter Exercise Price, Days Until Expiration, Interest Rates (%) and Volatility (%). We explicitly omitted taking yield into account to avoid confusion and keep this simple.

The Black–Scholes or Black–Scholes–Merton model is a mathematical model of a financial market containing derivative investment instruments. From the model, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of European-style options. The formula led to a boom in options trading and legitimised scientifically the activities of the Chicago Board Options Exchange and other options markets around the world. lt is widely used, although often with adjustments and corrections, by options market participants. Many empirical tests have shown that the Black–Scholes price is "fairly close" to the observed prices.

The app calculates theoretical price and option greeks using black-scholes model with the most accurate calculations around d1, d2, call and put prices with 16 decimal accuracy using cumulative distribution and standard normal distribution. For display purpose, we later round these values to 3 decimal places.

Assumptions of the Black and Scholes Model are as follows -

1. The stock pays no dividends during the option's life

2. European exercise terms are used

3. Markets are efficient

4. No commissions are charged

5. Interest rates remain constant and known

6. Returns are lognormally distributed

The Black Scholes Formula -

c= S + p – Xe – r(T-t)

p = c – S + Xe – r(T-t)

Where

c = call value

S = current stock price

p = put price

X = exercise price

e = Euler's constant (exponential function on a financial calculator equal to approximately 2.71828)

r = continuously compounded risk free rate of interest

T = Expiration date

t = Current value date

The Option Greeks taken into account along with their meaning are as follows -

1. Delta - measures the rate of change of option value with respect to changes in the underlying asset's price. Measures the exposure of option price to movement of underlying stock price

2. Vga - measures sensitivity to volatility. Measures the exposure of the option price to changes in volatility of the underlying

3. Theta - measures the sensitivity of the value of the derivative to the passage of time. Measures the exposure of the option price to the passage of time

4. Rho - measures sensitivity to the interest rate: it is the derivative of the option value with respect to the risk free interest rate

5. Gamma - measures the rate of change in the delta with respect to changes in the underlying price. Measures the exposure of the option delta to the movement of the underlying stock price

We have added the above definitions along with historical view.

You can easily switch for Call and Put calculations and you can also use the reset button to clear all the values. It is a simple one page application without any complexity for quick calculations and analysis around option pricing.

DISCLAIMER: Although we try really hard to list out all the nitty-gritty around our option greeks calculator and give you accurate output, we cannot be held responsible for any resulting loss from inaccuracies or via any other means. All information provided via Option Greeks Calculator must be used for information purpose only and not investment advice.

WE CONNECT YOU TO THE GREEKS! CARE TO CONNECT WITH US?

Facebook: https://facebook.com/speculometer

Twitter: http://twitter.com/speculometer

eMail: speculometer@gmail.com

Website: http://www.speculometer.com

SPECULOMETER :-)

About Option Greeks Calculator

Option Greeks Calculator is a free app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops Option Greeks Calculator is SpeculoMeter. The latest version released by its developer is 32.0.0.

To install Option Greeks Calculator on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2019-09-04 and was downloaded 4 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the Option Greeks Calculator as malware as malware if the download link to com.speculometer.ogc is broken.

How to install Option Greeks Calculator on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the Option Greeks Calculator is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by Option Greeks Calculator will be shown. Click on Accept to continue the process.

- Option Greeks Calculator will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.